AMENDED LAW ON CORPORATE INCOME TAX (2025)

The National Assembly has formally adopted Law No. 67/2025/QH15 on Corporate Income Tax (CIT), effective from October 1, 2025, and applicable to the 2025 CIT tax period. The main highlights are as follows:

1.1 Expansion of Taxpayers

The Law on Corporate Income Tax expands the scope of CIT taxpayers to include e-commerce platforms and digital platforms through which foreign enterprises supply goods and services in Vietnam.

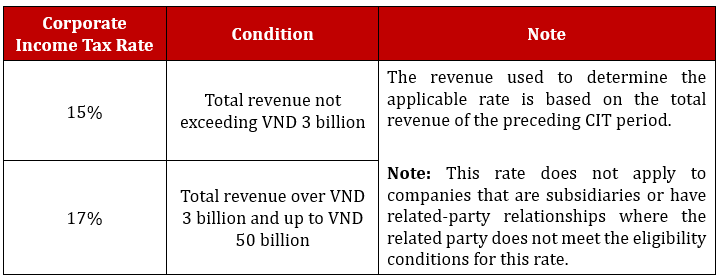

1.2 Tax Incentives for Small and Medium-Sized Enterprises with a Tax Rate of 15% or 17%

The corporate income tax rate remains at 20%.

1.3 Tax Calculation Method for Capital Transfers in Vietnam by Foreign Institutional Entities

According to the Draft Corporate Income Tax Law, capital transfer tax (applicable to the sale of shares in non-public joint-stock companies and the transfer of equity interests in limited liability companies) will be calculated at a rate of 2% on the total transfer price, regardless of whether there is a gain or loss.

The Corporate Income Tax Law recently passed by the National Assembly retains this provision, stipulating that CIT shall be applied at a fixed rate on the total transfer value instead of the previous method of taxing net income (transfer price minus cost basis). However, the law does not specify the exact rate, which will be determined in the forthcoming implementing decree.

1.4 Changes to Tax Incentive Beneficiaries

Addition of Certain Sectors Eligible for Tax Incentives:

- High-tech enterprises; agricultural enterprises applying high technology; science and technology enterprises.

- Services supporting SMEs, SME incubators; co-working space businesses supporting SMEs.

- Press activities (including advertising in the press).

Removal of Certain Sectors from the List of Tax-Incentive Beneficiaries:

- Biotechnology development.

- Refining of livestock, poultry, and aquatic feed.

- Production projects with capital of VND 6,000 billion or more.

- Investment projects in high-tech parks outside high-tech fields.

Adjustment of Provisions Related to Geographic Areas Eligible for Tax Incentives:

- Industrial parks will no longer receive area-based tax incentives. Accordingly, new or expanded projects in industrial parks will no longer benefit from 2 years of tax exemption and 4 years of 50% tax reduction.

- Reduced incentives for economic zones not located in socio-economically disadvantaged or especially disadvantaged areas.

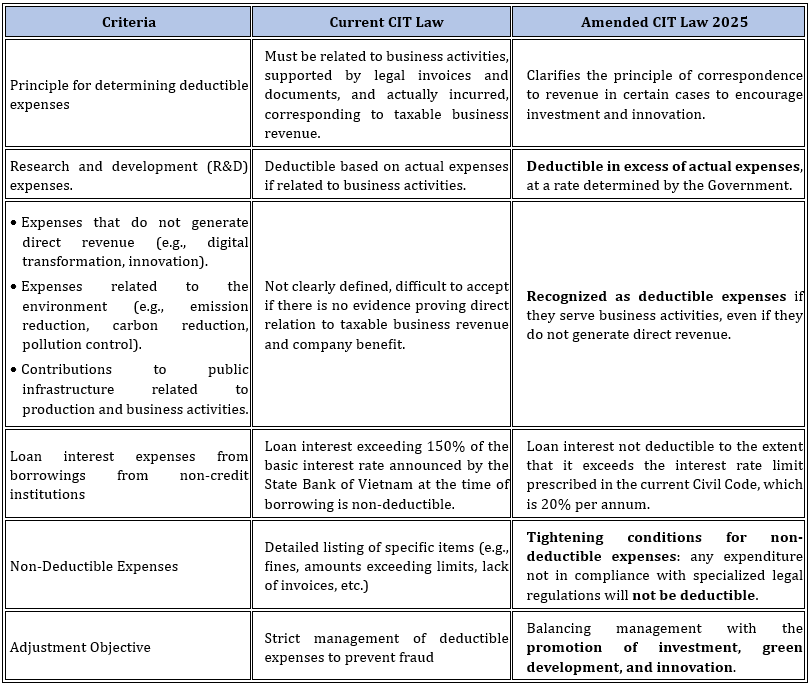

1.5 Additional Provisions on Non-Deductible Expenses