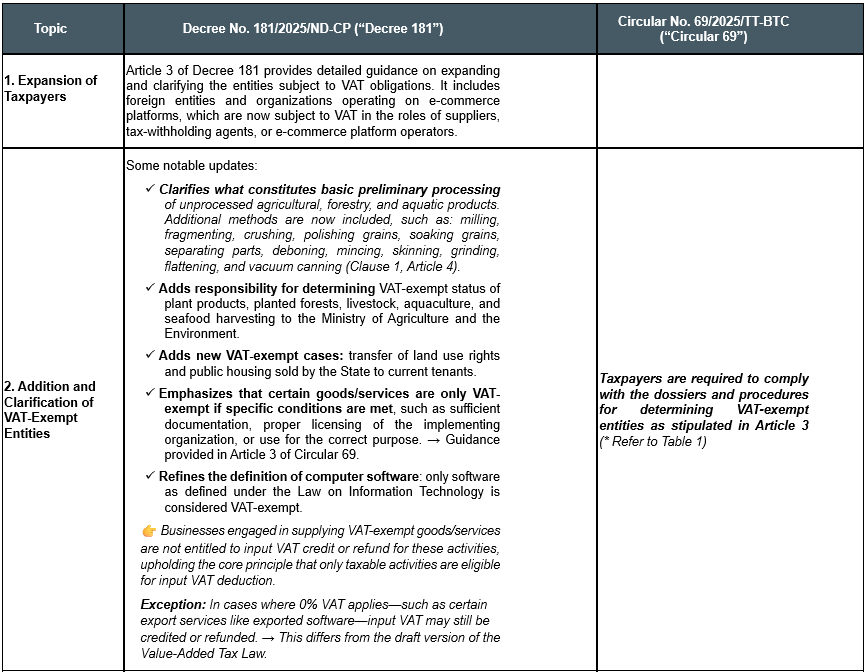

CIRCULAR NO. 69/2025/TT-BTC PROVIDING DETAILED GUIDANCE ON CERTAIN ARTICLES OF THE LAW ON VALUE-ADDED TAX AND IMPLEMENTATION OF DECREE NO. 181/2025/ND-CP DATED JULY 1, 2025, OF THE GOVERNMENT DETAILING THE IMPLEMENTATION OF CERTAIN ARTICLES OF THE LAW ON VALUE-ADDED TAX

Decree No. 181/2025/ND-CP and Circular No. 69/2025/TT-BTC mark a significant step forward in enhancing transparency and preventing tax losses. Enterprises are required to promptly update and make adjustments to minimize risks and ensure their entitlement to input VAT credit and tax refunds.

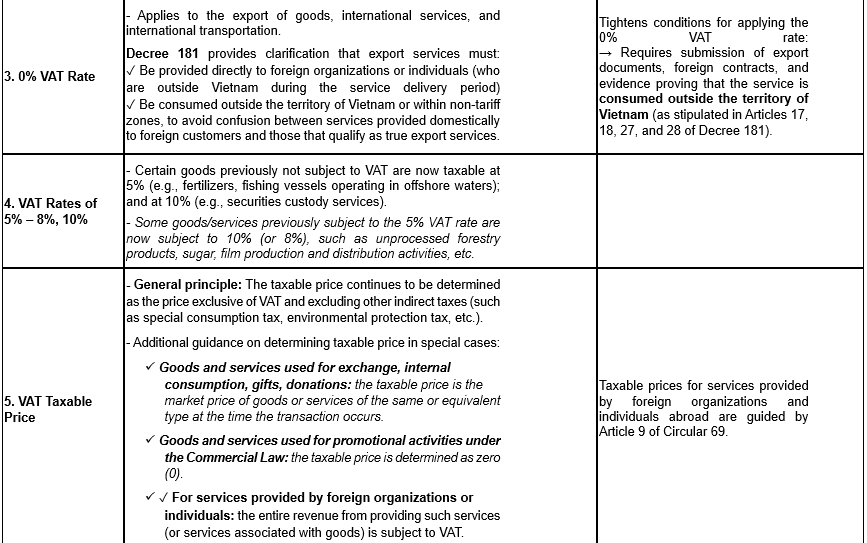

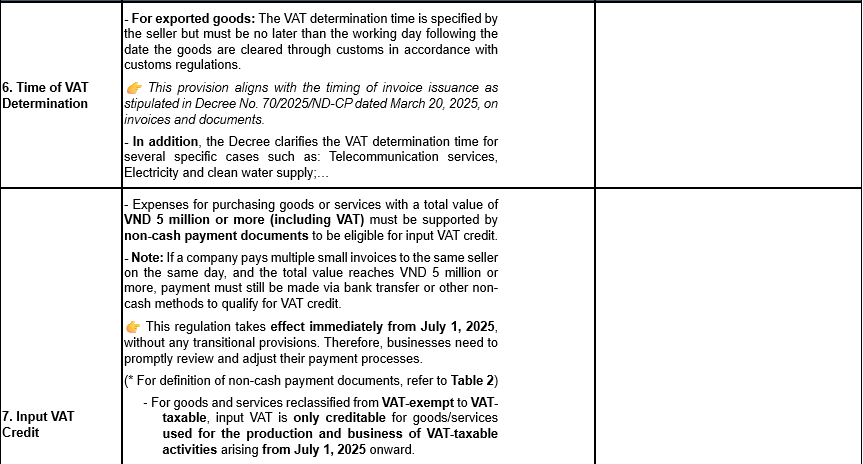

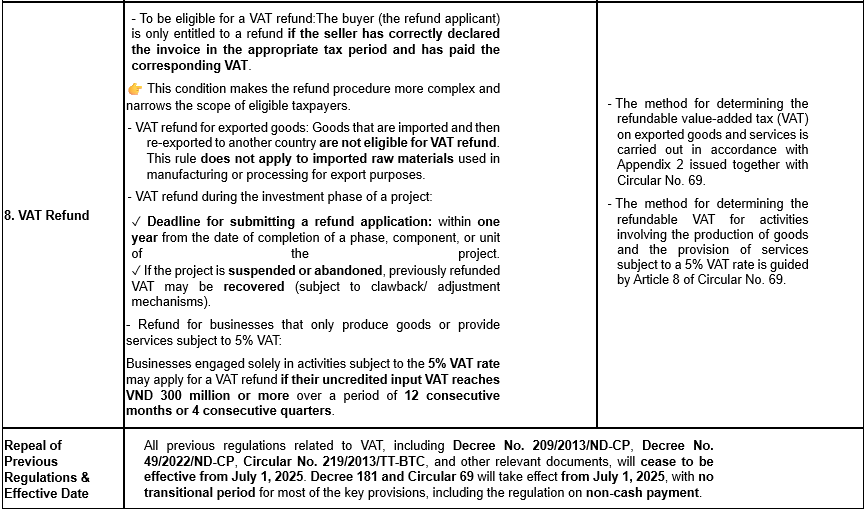

In addition to the new points already updated under the 2024 VAT Law, Decree No. 181/2025/ND-CP and Circular No. 69/2025/TT-BTC introduce notable changes in VAT regulations as follows:

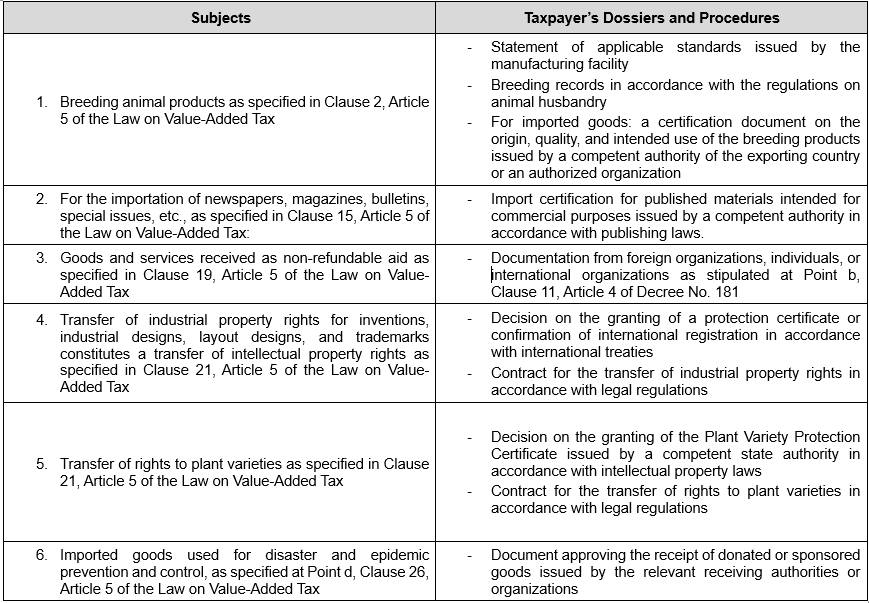

Table 1: Dossiers and Procedures for Determining Entities Not Subject to Value-Added Tax (Article 3, Circular No. 69)

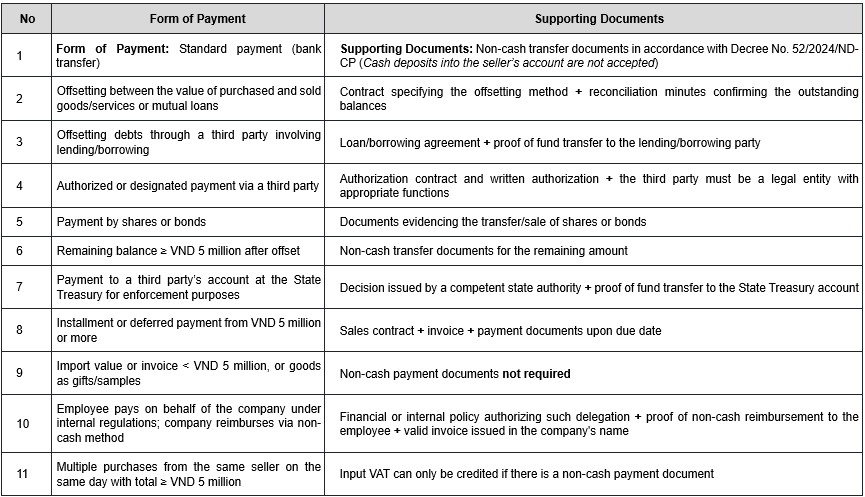

Table 2: Summary of 11 forms of non-cash payment and supporting documents (Article 26 of Decree 181)

Supporting documents and instruments used for non-cash payment under Decree No. 52/2024/ND-CP:

- Payment documents: cheques; payment orders; debit authorizations; collection authorizations; collection requests.

- Payment instruments: bank cards, including: debit cards, credit cards, prepaid cards; e-wallets; and other payment instruments as regulated by the State Bank of Vietnam (SBV).