DECREE NO. 174/2025/ND-CP ON THE VALUE-ADDED TAX (VAT) REDUCTION POLICY AS STIPULATED IN RESOLUTION NO. 204/2025/QH15 DATED JUNE 17, 2025, OF THE NATIONAL ASSEMBLY

On June 17, 2025, the National Assembly passed Resolution No. 204/2025/QH15, deciding to reduce the Value-Added Tax (VAT) rate from 10% to 8%, applicable from July 1, 2025, until December 31, 2026.

To implement this policy, the Government issued Decree No. 174/2025/ND-CP dated June 30, 2025, detailing the implementation of the VAT reduction as stipulated in Resolution No. 204/2025/QH15 of the National Assembly. Specifically:

1.1 Expansion of VAT reduction scope

- Decree No. 174/2025/ND-CP expands the scope of the 2% VAT rate reduction (from 10% to 8%) to include goods and services such as information technology, prefabricated metal products, coal (at importation and trading stages), coke, refined petroleum, chemical products, petrol and oil.

- The application of the 8% VAT rate is uniformly implemented across all stages: importation, manufacturing, processing, and commercial circulation for goods and services eligible for tax reduction.

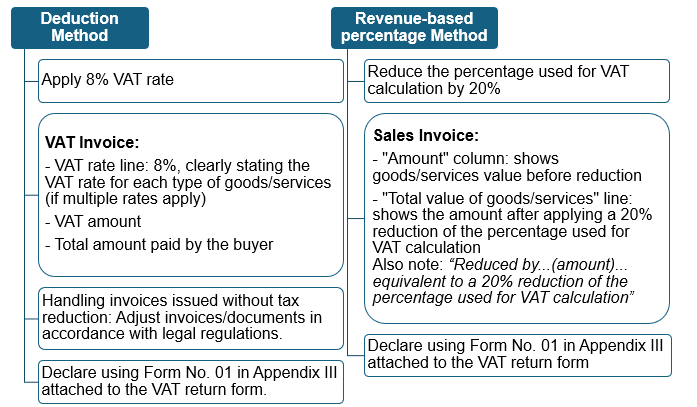

1.2 VAT reduction level; implementation procedures

Decree No. 174/2025/ND-CP takes effect from July 1, 2025, until December 31, 2026, creating favorable conditions for enterprises to enjoy a preferential value-added tax (VAT) rate, thereby helping to reduce costs, improve operational efficiency, and promote business and production development.